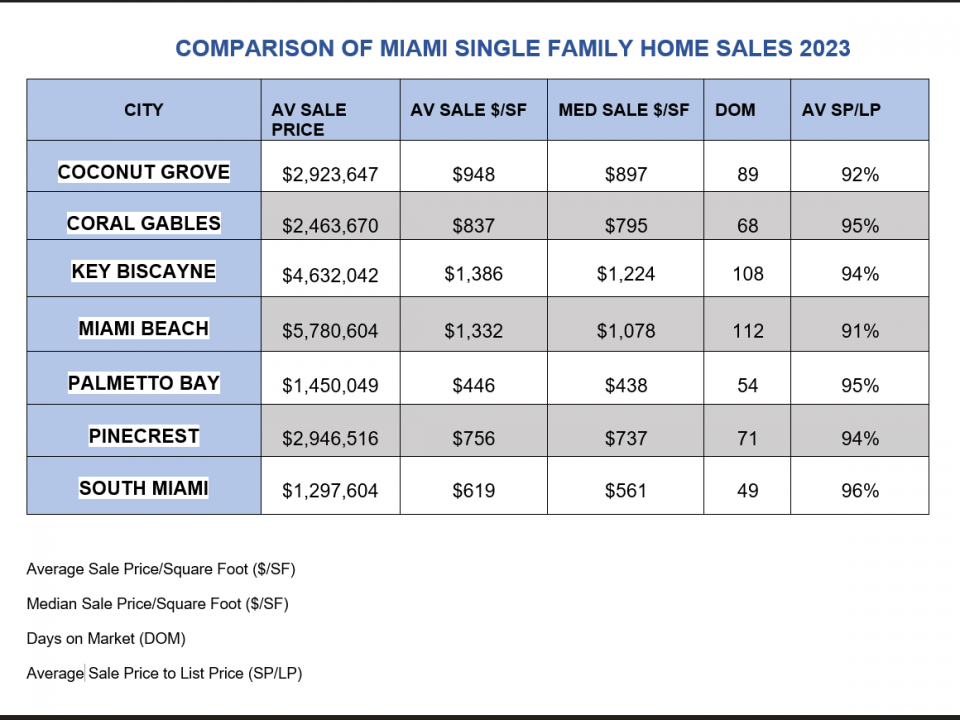

How to Calculate Your Real Estate Tax Portability when Downsizing Homes

So often, I’m asked how to calculate the real estate tax savings or tax portability when downsizing homes. Here’s a clear and simple example that I provided to one of my sellers in Pinecrest. Use it as a template for your own numbers.

So often, I’m asked how to calculate the real estate tax savings or tax portability when downsizing homes. Here’s a clear and simple example that I provided to one of my sellers in Pinecrest. Use it as a template for your own numbers.

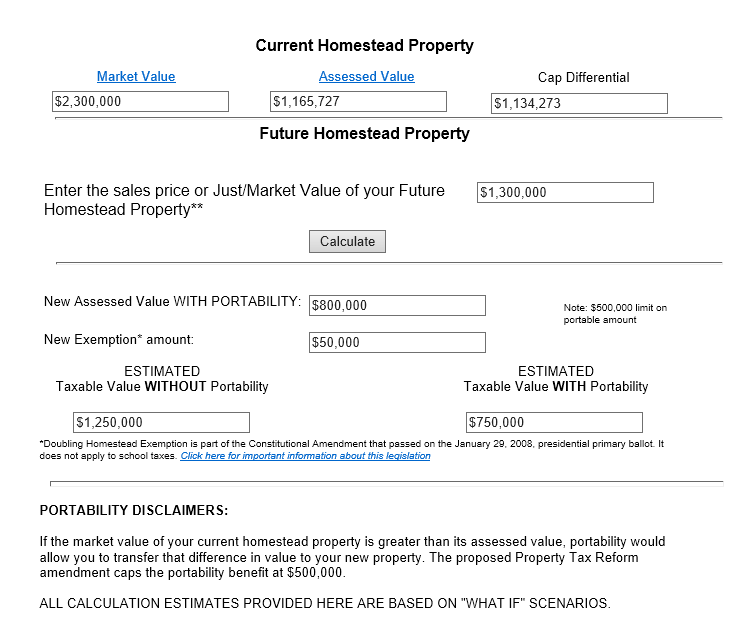

Take a look at the chart. If you own a home that has a current market value of $2,300,000 with an assessed value of $1,165,000, the cap difference is $1,134,273. You are allowed to “port” or transfer up to a maximum of $500,000 of this.

Let’s say you’re purchasing a new property for $1,300,000. You new assessed value with the port of $500,000 is now $800,000. Deduct the $50,000 exemption and your new estimated taxable value with portability is $ 750,000.

Big Difference!

If you need any further info on tax portability or have any questions on Miami real estate, I’m happy to help. 305-898-1852 Wellins.D@ewm.com