Tax – Real Estate Information

July 6, 2024

Are you considering financing to purchase a home? Then make sure you understand the crazy cost of mortgage points? What are Mortgage Points? Mortgage points are optional fees paid directly to your lender at closing in exchange for a reduced interest rate on your loan. It’s known as buying down the rate. A lower interest […]

October 29, 2016

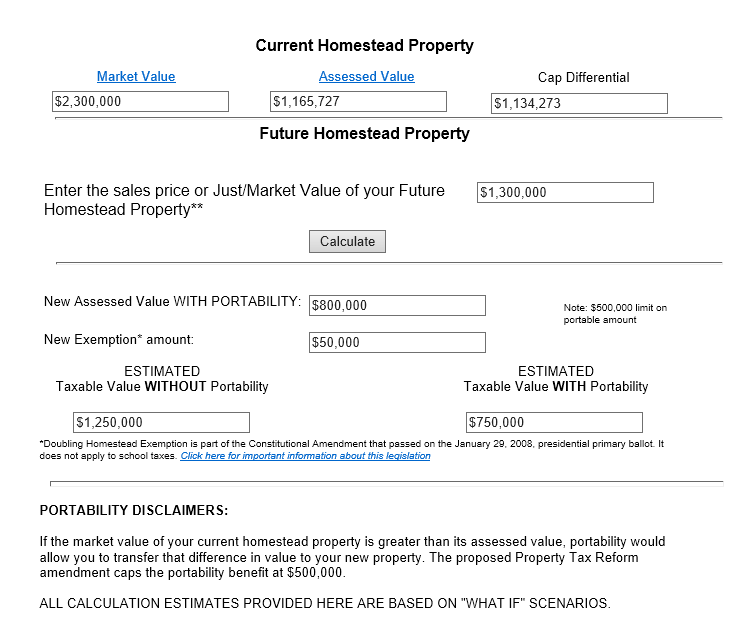

So often, I’m asked how to calculate the real estate tax savings or tax portability when downsizing homes. Here’s a clear and simple example that I provided to one of my sellers in Pinecrest. Use it as a template for your own numbers. Take a look at the chart. If you own a home that has a current market value of $2,300,000 with […]

April 9, 2014

Home office deductions are definitely a red flag to the Internal Revenue Service, increasing the likelihood of an audit. However, the deductions may be worth the risk. Meet These Criteria Regularly use the space exclusively for business If it is not a separate structure such as a studio or converted garage, it must be a room where no […]

December 11, 2013

There are several new exemptions that may lower your property tax bill. Determine if you qualify for exemptions by attending the Town Hall meeting hosted by Miami-Dade County Property Appraiser Carlos Lopez-Cantera. He will be speaking at the Pinecrest Library on Thursday December 19, 2013 at 7 pm to discuss these exemptions. You can also complete your exemption application at […]

December 9, 2013

Homeownership has tax advantages. The down payment on the purchase of a house is not deductible. However, these four items are deductible on your annual U.S. income taxes. Mortgage loan interest Real estate taxes Closing fees that decrease the rate of the mortgage loan Mortgage insurance required on all FHA and VA loans, and on conforming or […]

September 25, 2013

The Village of Pinecrest is making it easier for homeowners to obtain 100% financing to protect their homes from hurricanes, save energy, lower utility cost and make their homes safer and healthier. The Clean Energy Green Corridor program offers homeowners an opportunity to finance home improvement projects that include: Impact Windows or Storm Shutters New […]

September 19, 2013

A buyer recently inquired about the value difference in buying undeveloped residential land vs a tear down. When you purchase land, the major considerations are location, size and shape of the property, size of the home you wish to build and limitations due to protected trees. There are also impact fees associated with new construction. […]

May 5, 2013

If you are moving because of a new job or even the same job at a new location, the IRS offers these tax tips on expenses you may be able to deduct on your tax return. Expenses must be close to the time you start work – Generally, you can consider moving expenses that you incurred within […]